Coffee is the second most consumed beverage after water and holds a significant place in global economies. At Craft Coffee Spot, we wanted to analyze where coffee is produced and consumed, including top coffee-producing countries, export destinations, and the impact of climate change on the industry.

We reviewed over a dozen sources for the latest coffee production statistics and coffee export statistics. Discover the figures and trends that shape the coffee trade, highlighting the dynamic nature of this age-old commodity in today’s ever-evolving market.

Major Coffee-Producing Countries

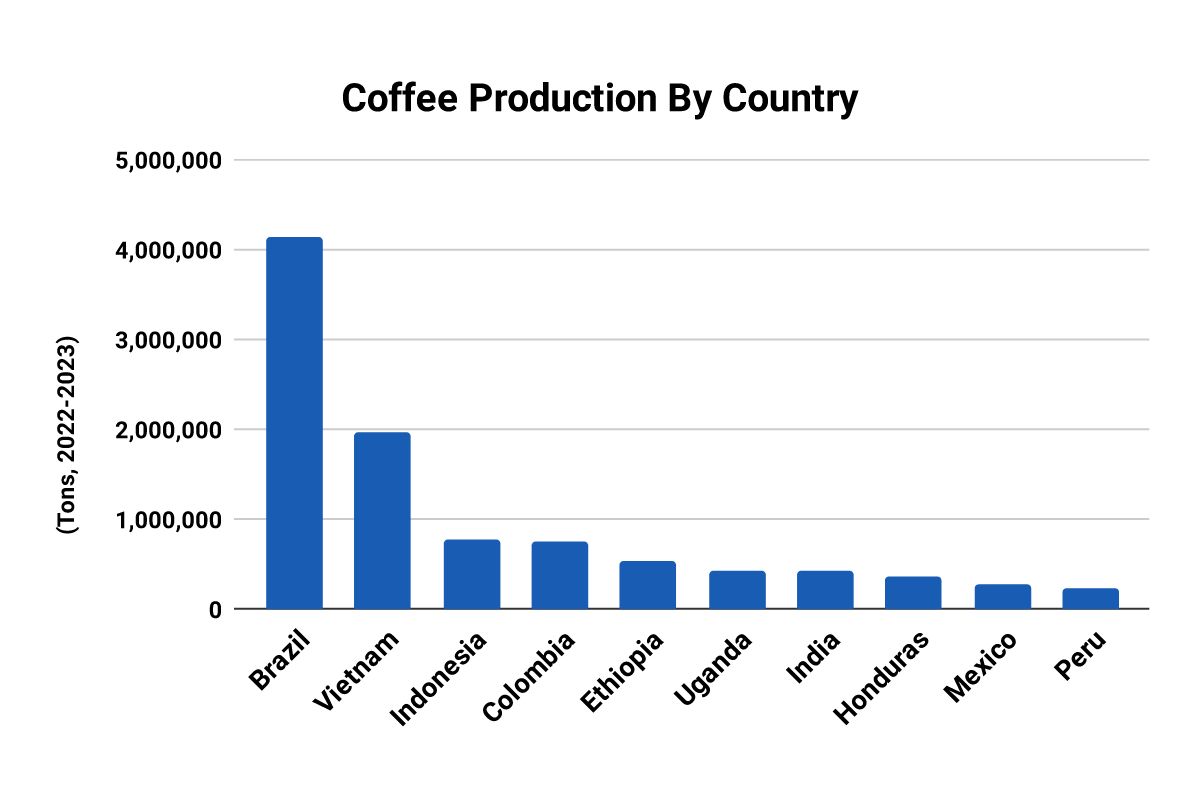

The top ten coffee-producing countries for the coffee year 2022-2023 (in thousand 60 kg bags) were [1]:

| Country | 60kg bags | Tons |

|---|---|---|

| Brazil | 62,600 | 4,131,600 |

| Vietnam | 29,750 | 1,963,500 |

| Indonesia | 11,850 | 782,100 |

| Colombia | 11,300 | 745,800 |

| Ethiopia | 8,270 | 545,820 |

| Uganda | 6,565 | 433,290 |

| India | 6,520 | 430,320 |

| Honduras | 5,400 | 356,400 |

| Mexico | 4,089 | 269,874 |

| Peru | 3,625 | 239,250 |

Coffee requires a very specific terroir, including a temperate climate with plenty of rain, mineral-rich soil, and high elevations (to slow bena. These conditions are uncommon globally and concentrate coffee production in a dozen countries within the “Bean Belt” located between the Tropic of Cancer and the Tropic of Capricorn. I spent time understanding coffee production within individual countries.

The majority of coffee production is concentrated in South America, thanks to Brazil, Colombia, and Peru. Brazil alone accounts for a substantial portion of the world’s coffee production, being the leading coffee producer globally. Brazil has a flat topography compared to other regions, which allows large-scale, mechanized harvesting of coffee cherries. This is unusual in other countries where coffee trees tend to grow on mountainous slopes.

Asia also contributes significantly to the world’s coffee production, mostly thanks to Vietnam, Indonesia, and India, with Vietnam being the second-largest coffee-producing country globally. Vietnam is a little unique as the country produces mostly Robusta coffee varieties, which are traded differently than Arabica.

Ethiopia and Uganda are representative of the African continent in the top ten coffee-producing countries. Ethiopia is one of the world’s oldest coffee producers, and both countries play a crucial role in supplying Arabica coffee to the global market.

Mexico, Honduras, and Guatemala have the highest coffee production in Central America, though their production volume is relatively smaller compared to the South American and Asian countries.

Data note: official sources report coffee production in 60kg units, the standard weight for a burlap jute bag from the farm.

Years are production years, which cover a July-June timeframe. The 2022-2023 season lasts from July 1, 2022, through June 30, 2023.

Arabica vs. Robusta Production

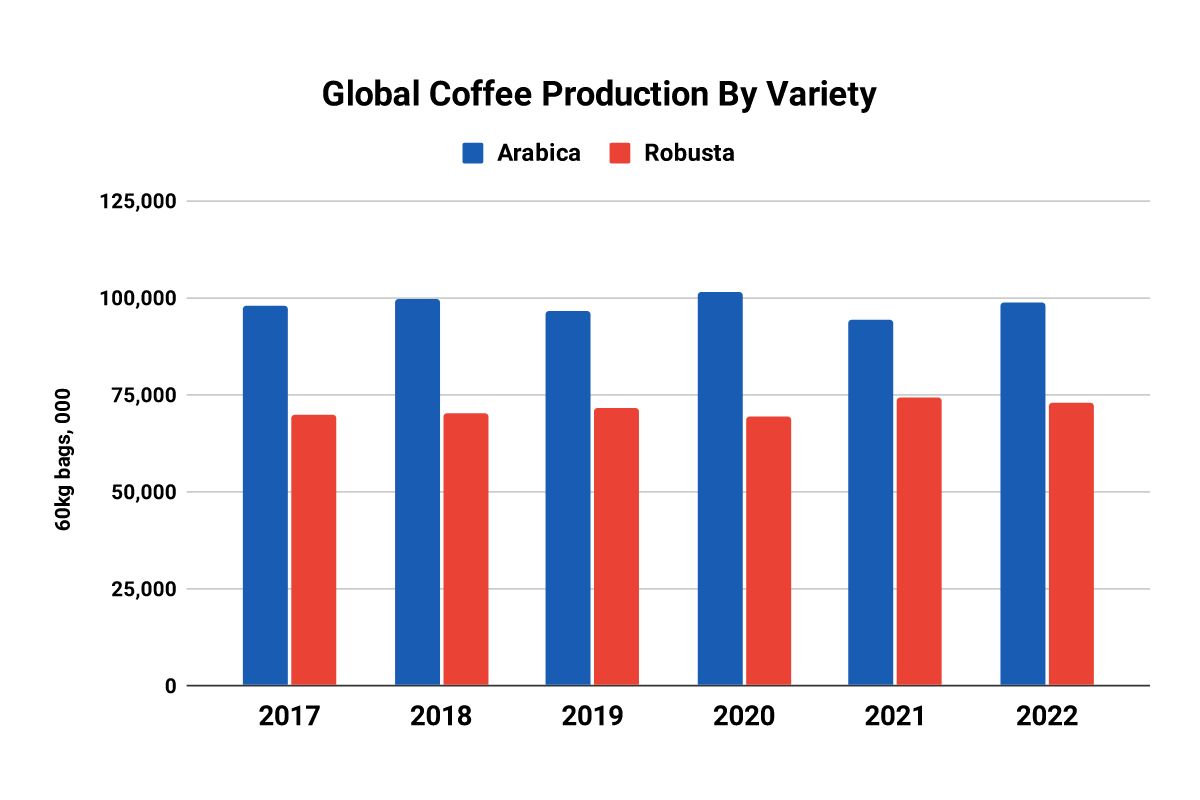

In 2022, 98,559 60 kg bags of Arabica were produced, compared to 72,709 60 kg bags of Robusta. 57.5% of all coffee production is Arabica, compared to 42.5% Robusta [2].

The coffee year 2021/2022 saw a sharp decline in Arabica production — by 7.2%. The production of Arabica fell to 94.3 thousand bags from 101.6 thousand bags the previous year. This is the sharpest decline in the last 19 years and happened because of the drop in South American coffee output.

On the other hand, the same year saw a 7.1% increase in Robusta production. Vietnam is the largest producer of Robusta worldwide, and the country had an output increase of 14.9%, which equaled 30.8 million bags.

Overall, there are three main reasons that affected the dynamics of Arabica vs. Robusta production in 2022:

- The off-biennial production in Brazil

- Adverse meteorological conditions in Colombia

- Bumper year in Vietnam

It’s expected that Arabica vs. Robusta production will change in the coffee year 2022/2023. The biennial impact will be positive for Brazil’s Arabica production and will have a negative impact on Vietnam’s production. However, so far, in 2023, Robusta has reached a 28-year high, and the differences between Arabica and Robusta are getting increasingly narrowed [3].

Global Coffee Production Statistics

Here’s how coffee production changed worldwide over the last ten years.

Production Volume Over the Past Decade

Total world coffee production in the coffee year 2011/12 was 134,416 thousand 60 kg bags [4]. Total world coffee production in the year 2022 was 171,268 thousand 60 kg bags [5]. The total world coffee production increased by approximately 27.44% from the coffee year 2011/12 to the year 2022.

Here’s coffee production over the last decade per region:

| Region | Production in 2011/2012 | Production in 2022 | Total % Growth |

|---|---|---|---|

| South America | 58,857 | 82,424 | 40.0% |

| Asia & Oceania | 41,046 | 49,713 | 21.1% |

| Mexico and Central America | 19,699 | 19,726 | 0.1% |

| Africa | 14,814 | 19,405 | 30.9% |

Almost all major coffee-producing regions saw a substantial increase. South America had the largest increase in the last decade, at 40.0%. Interestingly, Africa had the largest increase in coffee production in the last decade, at 30.9%. Asia & Oceania experienced a moderate increase of around 21.1%, Mexico and Central America remained mostly the same, with a small increase of 0.1%.

The main reason why Mexico and Central America’s output remained the same was the spread of coffee leaf rust that started in 2012. By the 2013/14 harvest, coffee leaf rust had spread to over 50% of Mexico’s coffee area [6].

Coffee leaf rust, also known as coffee rust or Hemileia vastatrix, is a fungal disease that affects coffee plants. It’s one of the most significant threats to coffee production worldwide. The fungus attacks the leaves of coffee plants, causing them to develop yellowish-orange powdery lesions on the upper surface. As the disease progresses, the infected leaves drop prematurely, leading to defoliation and poor coffee seed (aka coffee bean) production.

Over the years, coffee leaf rust outbreaks have caused major crises in coffee-producing regions, such as what happened in Mexico.

Trends and Changes in Global Production

The production of coffee decreased by 1.4% to 168,5 million bags in the coffee year 2021/2022. The production was hampered by the off-biennial production and negative meteorological conditions in several key producing countries. However, coffee production is expected to bounce back and increase by 1.7% to 171.3 million bags in 2022/2023 [6].

The coffee year 2022/2023 is expected to have a low coffee growth rate due to the increased prices of fertilizers and adverse weather conditions. For example, Colombia has a lower output due to excessive rain, and Honduras is struggling with coffee leaf rust. On the other hand, Peru has reduced labor availability during the harvest, which is also affecting the total output.

Decreased global production isn’t affecting coffee export, which is seeing an increase. World coffee export was 11.94 million bags in March 2021, which is a slight increase from March 2020, which was 11.66 million bags [7].

Impact of Climate Change on Coffee Production

Climate change has a major impact on coffee production. It’s been affecting the world of coffee since as early as the 1800s. During this time, Sri Lanka was a major coffee producer, with over 45,000 tons of coffee produced annually. In 1869, the country was hit with coffee leaf rust which completely killed Sri Lanka’s coffee industry.

More recently, Central America experienced rising temperatures in 2012/2013, leading to a coffee rust crisis. Honduras, Costa Rica, and Guatemala even declared a state of emergency. Over half of the planted area was destroyed, and over 350,000 people lost their jobs [8].

In 2021, Brazil was hit with the worst frost in the last 50 years. Over 200,000 hectares of land used to cultivate coffee were hit by four rounds of frost between the end of June and July. Due to the combined effects of frost and drought, Brazil is expected to lose around 36 million bags in harvest from 2022 to 2025.

Overall, climate change has significant implications for coffee production worldwide. As a climate-sensitive crop, coffee is vulnerable to changes in temperature, rainfall patterns, and extreme weather events.

The impact of climate change on coffee production includes:

- Shifting Suitable Growing Areas — The optimal conditions for coffee cultivation, such as specific temperature ranges and altitudes, are becoming less predictable due to climate change. Some traditional coffee-growing regions may become less suitable for coffee production, leading to a shift in cultivation areas.

- Reduced Coffee Yields — Rising temperatures and changing rainfall patterns negatively affect coffee yields. Prolonged droughts, heatwaves, or excessive rainfall during flowering and fruit development stages lead to reduced flower and fruit formation, impacting crop productivity.

- Increased Disease Pressure — Warmer temperatures and higher humidity can lead to a rise in coffee berry borer, coffee leaf rust, and other pathogens, causing significant damage to coffee crops.

- Altered Coffee Quality — Climate change may alter the chemical composition of coffee beans, affecting their flavor, aroma, and quality. Extreme weather conditions can lead to uneven ripening, resulting in inconsistent cup profiles.

Major Coffee Exporting Countries

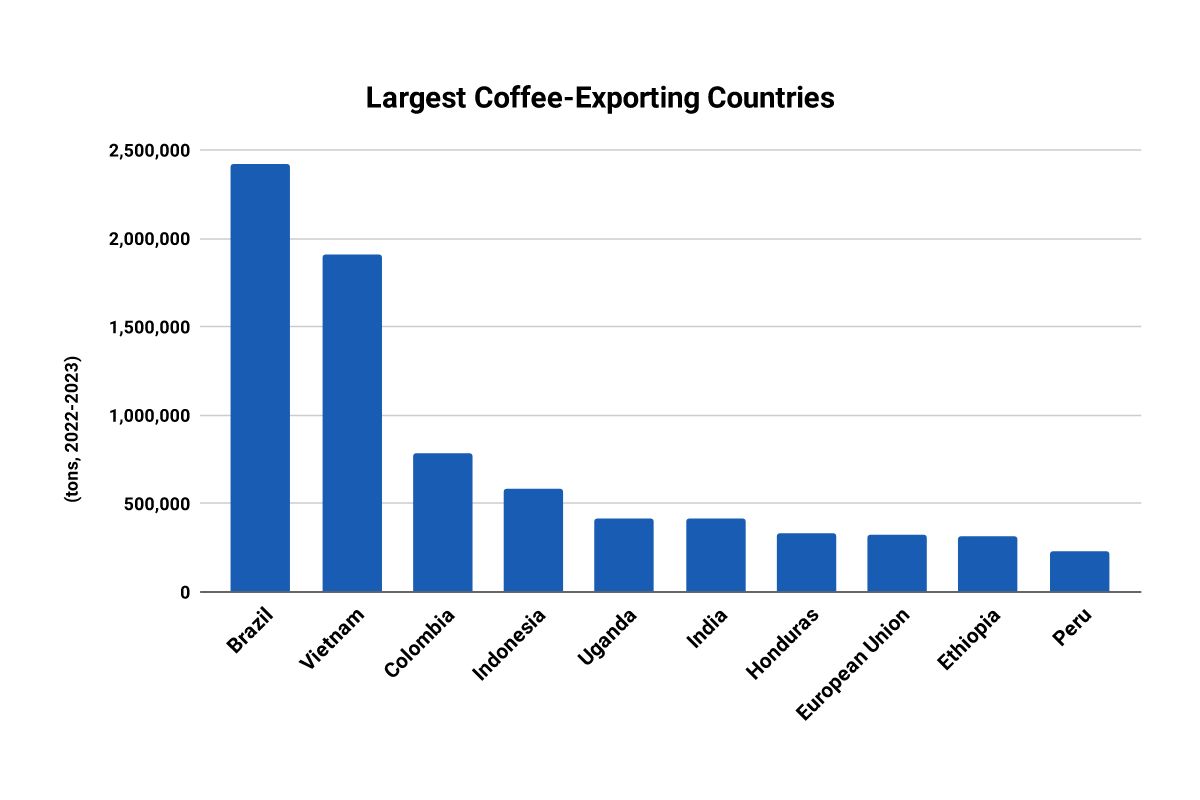

These are the top ten major coffee exporting countries in the coffee year 2022/2023 per thousand 60 kg bags [9]:

| Country | 60kg bags (000) | Tons |

|---|---|---|

| Brazil | 36,645 | 2,418,570 |

| Vietnam | 28,900 | 1,907,400 |

| Colombia | 11,900 | 785,400 |

| Indonesia | 8,795 | 580,470 |

| Uganda | 6,250 | 412,500 |

| India | 6,225 | 410,850 |

| Honduras | 5,000 | 330,000 |

| European Union | 4,900 | 323,400 |

| Ethiopia | 4,820 | 318,120 |

| Peru | 3,490 | 230,340 |

Overall, the top four coffee-exporting countries are the same as the top four coffee-producing countries, with some differences in the order of ranks. Exporting countries like Brazil, Vietnam, Colombia, and Indonesia are major players in both aspects, reflecting their significant roles in the global coffee market.

The European Union is unique as an exporter since the region is unsuitable for growing coffee given its far from the equator. However, the European Union plays a significant role in coffee export. The EU has a well-established coffee processing and re-export industry. Germany is the largest green bean importer and re-exporter, and Italy is the largest European coffee roasting hub [10].

Interestingly, while Brazil remains the largest coffee exporting country, the amount of exported coffee has largely decreased. In 2011, Brazil accounted for 23.2% of the total coffee world coffee export. In 2021, Brazil remained the largest coffee exporter, but this percentage was only 16.8% [11].

Key Importing Countries

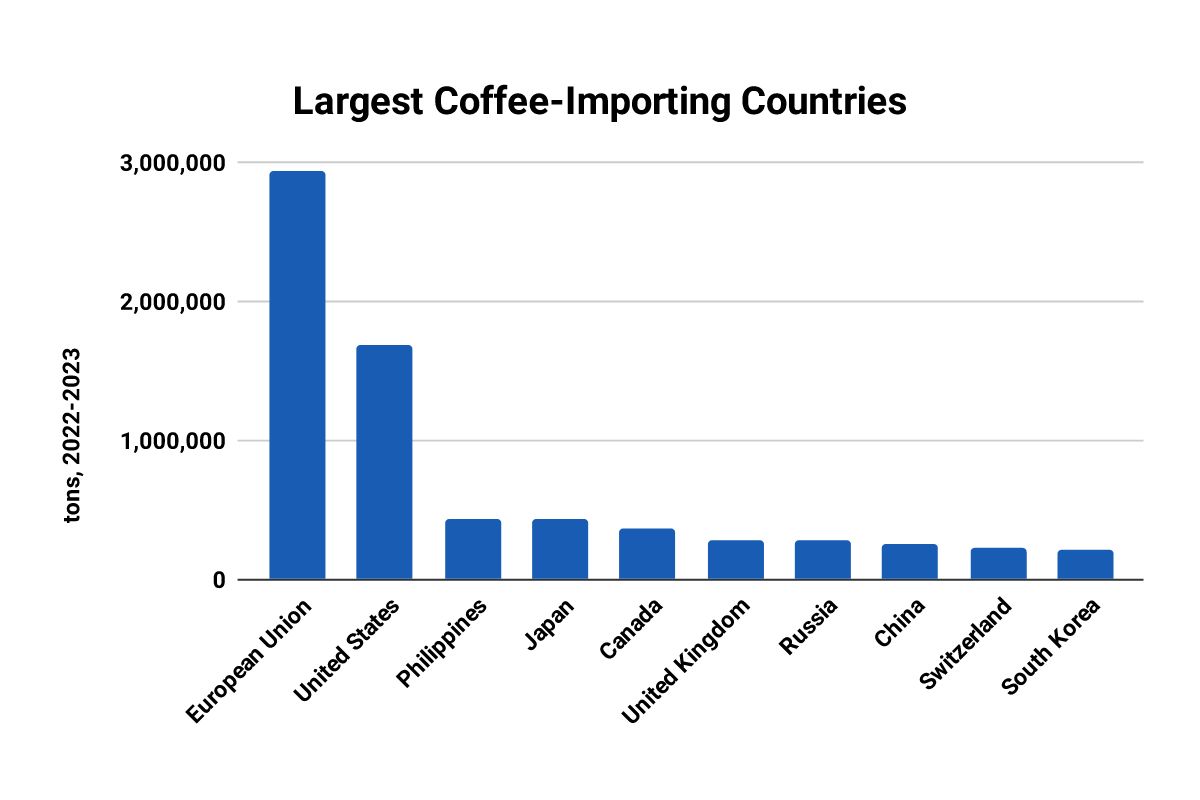

These are the top ten major coffee importing countries in the coffee year 2022/2023 per thousand 60 kg bags [12]:

| Country | 60kg bags | Tons |

|---|---|---|

| European Union | 44,500 | 2,937,000 |

| United States | 25,615 | 1,690,590 |

| Philippines | 6,590 | 434,940 |

| Japan | 6,550 | 432,300 |

| Canada | 5,485 | 362,010 |

| United Kingdom | 4,250 | 280,500 |

| Russia | 4,250 | 280,500 |

| China | 3,875 | 255,750 |

| Switzerland | 3,400 | 224,400 |

| South Korea | 3,165 | 208,890 |

Europe is the largest coffee importer, as various European countries have a strong coffee culture and high coffee consumption. It’s followed by North America, where the US and Canada are the largest importers. Asia is next, with the Philippines, Japan, China, and South Korea as the largest importing Asian countries.

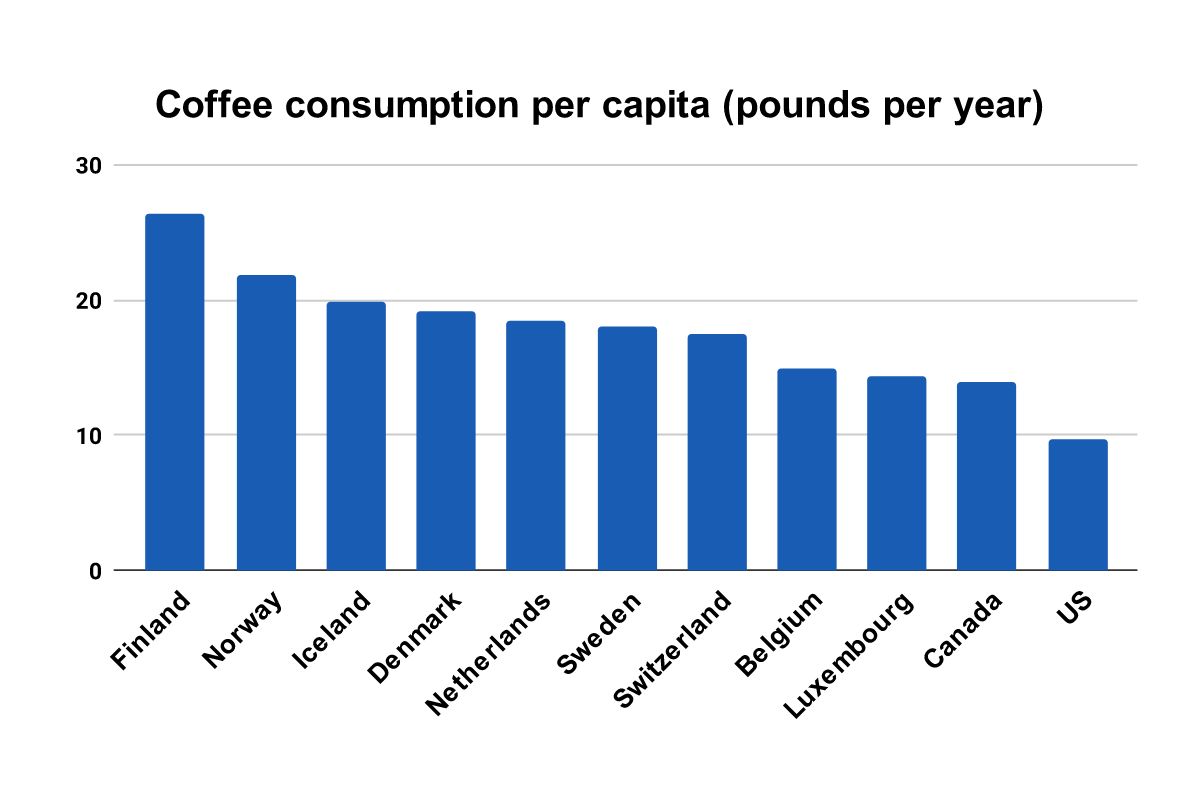

Coffee Consumption Per Capita

The top ten countries that consume the most coffee per capita are [13]:

| Country | Per capita consumption (pounds/year) |

|---|---|

| Finland | 26.45 |

| Norway | 21.82 |

| Iceland | 19.84 |

| Denmark | 19.18 |

| Netherlands | 18.52 |

| Sweden | 18 |

| Switzerland | 17.42 |

| Belgium | 15 |

| Luxembourg | 14.33 |

| Canada | 14 |

Europeans consume the most coffee per capita worldwide, particularly Scandinavian countries. The only country on the list not located in Europe is Canada!

On the other hand, annual consumption per person in the US is 9.7 lbs, which ranks the US 25th on the list of biggest coffee consumers worldwide [14]. An average American drinks 1.87 cups of coffee daily, which has remained largely unchanged during the last decade [15].

What Do Coffee Production and Export Statistics Reveal?

The top coffee-producing countries, led by Brazil, Vietnam, and Indonesia, play a critical role in shaping the coffee trade. The trends in Arabica and Robusta production highlight the dynamic nature of the industry, influenced by factors like off-biennial cycles, climate conditions, and price changes.

Over the past decade, coffee production has experienced significant growth, with South America and Africa showing remarkable increases. However, climate change poses a serious threat to coffee production, leading to shifting cultivation areas, reduced yields, and increased disease pressure.

Despite these challenges, major coffee-exporting countries like Brazil, Vietnam, and Colombia, along with the top importing nations in Europe and North America, continue to drive the global coffee market.

Finally, the consumption per capita data underscores Europe’s strong coffee culture, particularly in Scandinavian countries like Finland and Norway.